Centaur Media plc , the business information, events and marketing services group, has issued an interim management statement for the period to 14 May 2013 and announced that CEO, Geoff Wilmot is to leave.

Centaur Media plc , the business information, events and marketing services group, has issued an interim management statement for the period to 14 May 2013 and announced that CEO, Geoff Wilmot is to leave.

Profits before tax will be nearly a quarter less than analysts had forecast, at £8.5m for the year. The company is blaming the miss on poor performance in their print, recruitment and overseas revenues

According to the Financial Times Geoff Wilmot was dismissed following a board meeting on Tuesday. Mark Kerswell, Centaur’s chief financial officer and formerly chief operating officer of Informa, will take over as interim chief executive.

Tim Potter, MD of the Business Publishing division has also left Centaur.

The full announcement is below:

As a result of a number of factors annotated below, the Board now expects to deliver modest profit growth for the current financial year to 30 June 2013, relative to the adjusted profit before tax of £8m reported last year. This is below market expectations.

Current trading and outlook

Reported Group revenues in the four months to 30 April 2013 are 8% ahead of the same period last year. Total underlying revenues in the same period were down by 2% compared to the 3% underlying decline in H1. On the same underlying basis, digital revenues grew by 4% compared to 1% in H1, events revenues grew by 7% compared to 12% in H1, and print revenues fell by 14%, in line with H1.

May and June represent two of Centaur’s most important trading months, typically generating in the region of 45% of full year EBITDA. Visibility of advertising revenues for this period still remains limited and delivery of corporate training revenues is also volatile.

Although revenue trends and forward bookings are improving, the Board does not now anticipate underlying revenues for the Group as a whole returning to growth in the remainder of the financial year to 30 June 2013, as had previously been anticipated.

The principal factors impacting the underlying and reported performance across the Group are:

- Weakness in print advertising, which has been most evident across the financial titles. The Board had anticipated a significant improvement in performance in line with recovering stock markets. However, the introduction of the Retail Distribution Review in January 2013 has had a more marked impact than was anticipated on forecast levels of print advertising spend in this financial year.

- Despite improving economic conditions, recruitment revenues have not yet returned to growth as was anticipated when the Group published its half year results in February 2013.

- Econsultancy’s overseas operations have incurred losses, primarily as a result of the deferral of corporate training contracts into the next financial year.

The impact of these factors has been partially offset by the effect of prior year cost savings and growth in other parts of the Group. However, the operational leverage associated with these revenues means that the Board now only expects to deliver modest profit growth relative to adjusted profit before tax of £8m reported last financial year.

Board and organisational changes

Geoff Wilmot is stepping down as CEO but has agreed to remain with the business until the end of the financial year in order to implement a smooth handover to Mark Kerswell, who is now interim CEO.

Tim Potter, MD of the Business Publishing division has decided to leave Centaur. The process to appoint his successor has commenced.

Business Publishing

Underlying revenues declined by 6% in the four months to 30 April compared to a 9% decline in H1. Digital display revenues grew by 17% in the four months to 30 April compared to a decline of 4% in H1. Events revenues grew by 3% in the four months to 30 April compared to a decline of 11% in H1.

Business Information

Underlying revenues declined, as expected, by 3% in the four months to 30 April compared to 3% growth in H1. Reported revenues, all of which are digital and events based, continue to show good rates of growth, reflecting the impact of recent acquisitions. Growth in reported digital revenues is being led by subscriptions growth across Econsultancy and Profile, where annualised contract values are growing in excess of 20% per annum. Econsultancy’s UK business continues to report strong growth in revenues and profits.

Exhibitions

Events revenues account for approximately two thirds of this division’s revenues and continue to deliver healthy growth, with underlying revenues 11% ahead in the four months to 30 April compared to 17% growth in H1. Growth in the final two months of the 2013 financial year is expected to be flat, but the outlook for growth in 2014 events revenues remains encouraging. The remainder of this division’s revenues comprise revenues from the specialist home interest publication brands, where both print and digital revenues continue to report good rates of underlying revenue growth.

Cash flow, balance sheet and exceptional items

Operating cash flow in the four months to 30 April 2013 was marginally lower than in the same period last year, reflecting higher levels of capital expenditure and working capital. Net debt at 30 April 2013 was £24.4m and will reduce in the final two months of the year. Exceptional costs in the second half of the year will include earn-out costs related to the acquisitions of FEM, IPL and VBR, the unwinding of the discount related to the Econsultancy earn-out, and further restructuring initiatives.

Patrick Taylor, Chairman, commented, “Although disappointed by the weak performance in our print, recruitment and overseas revenues we are continuing to make good progress in diversifying our revenue mix towards higher growth digital and events. Looking ahead, our investment in existing and new products has given us a strong pipeline of new digital platforms and event launches. With print revenues expected to stabilise, digital and events revenues growing well, and deferred revenues of £19m, 32% ahead of the same period last year, we believe that the outlook for the 2014 financial year remains positive.”

UK, London

Related articles:

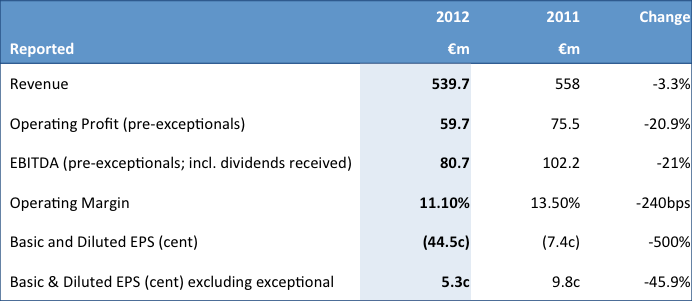

- Centaur Media plc – half year results for the six months ended 31 December 2012 Posted on February 22, 2013

- Centaur Media PLC – half year trading update Posted on January 11, 2013

- Centaur Media year-end trading statement Posted on July 17, 2012

- A Fusion Deal: Econsultancy sold to Centaur Posted on July 10, 2012

- Centaur Media acquires Profile Group Posted on February 21, 2012

- Centaur Media acquires Investment Platforms for up to £6.3M Posted on September 6, 2011

- Centaur Media plc reports profits at top end of expectations Posted on July 15, 2011

- Centaur Media plc to be restructured and to sell off some titles Posted on June 30, 2011

- Centaur Media PLC – Interim Management Statement Posted on May 12, 2011

- Centaur Media acquires The Forum for Expatriate Management for up to £6.75M April 7, 2011

- Centaur Media has acquired for Taxbriefs £1.9 million Posted on June 2, 2010

You must be logged in to post a comment.