Euromoney Institutional Investor PLC, the international publishing, events and electronic information group, has issued a trading update ahead of the announcement of its results for the half year to March 31, 2012.

Euromoney Institutional Investor PLC, the international publishing, events and electronic information group, has issued a trading update ahead of the announcement of its results for the half year to March 31, 2012.

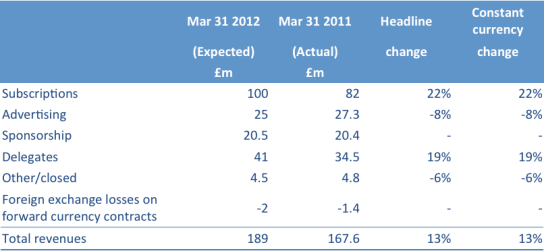

Group revenues for the six months to March 31, 2012 are expected to show an increase of 13% to £189 million. Underlying revenues, excluding the impact of last year’s acquisition of Ned Davis Research (NDR), increased by approximately 5%. Headline subscription revenues are expected to have increased by 22%, and accounted for 53% (2011: 49%) of the group’s revenues for the period. Underlying subscription revenues, excluding NDR, increased by approximately 7%, continuing the good momentum from 2011. Advertising and sponsorship revenues are down by 8%. The stronger performance of delegate revenues in the second quarter was mostly due to timing differences on events and the impact of the political unrest in the Middle East on delegate bookings last year.

The following table summarises the expected year-on-year revenue changes for the six months to March 31 at both headline rates and at constant currency:

For the half year to March 31, 2012, Euromoney expects to announce an adjusted profit before tax* of not less than £47 million (2011: £41.6 million). The adjusted operating margin^ is expected to be unchanged at 30%.

Group net debt at March 31, 2012 is expected to be no more than £90 million, down from £119.2 million at September 30, 2011. The reduction in net debt largely reflects the continued strong operating cash flows of the group.

Recent sales trends suggest the outlook for advertising revenues remains challenging, while the outlook for the events businesses, for which the third quarter is the most important of the year, is positive. Overall trading remains in line with the board’s expectations.

The half year results will be announced on the morning of May 17, 2012, followed by an analyst presentation and investor meetings. Euromoney is participating in the DMGT investor day on April 18 when it will give a presentation covering the importance of emerging markets to its growth strategy. No further comment on trading will be given at this meeting.

* Adjusted profit before tax is profit before tax, acquired intangible amortisation, exceptional items, deferred consideration adjustments and non-cash movements in acquisition option commitment values.

^ Adjusted operating profit is operating profit before acquired intangible amortisation, long-term incentive expense, exceptional items and share of results in associates.

UK, London

- A Fusion Deal: International grain trading conferences, Global Grain Geneva and Global Grain Asia, sold to Euromoney Institutional Investor Posted on February 29, 2012

- Euromoney Institutional Investor to acquire Ned Davis Research Group for £69M Posted on June 21, 2011

- Euromoney Institutional Investor PLC acquires Arete Consulting Posted on August 13, 2010

- A Fusion Deal: Euromoney sells EIC to Broadfern September 2007

You must be logged in to post a comment.