Euromoney Institutional Investor PLC, the international publishing, events and electronic information group, has announced its Interim Management Statement for the period from April 1 to July 24, 2012.

Highlights

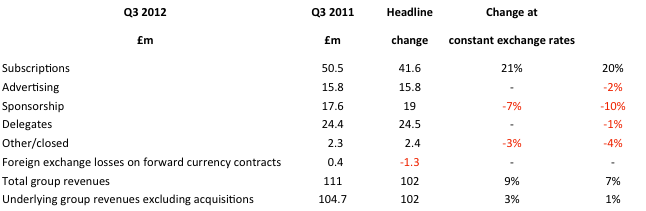

- Total revenues for the quarter to June 30, 2012 increased by 9% to £111.0 million, driven by continued growth from the group’s research and data businesses. Underlying group revenues, excluding the impact of last year’s acquisition of Ned Davis Research, increased by 3% (and by 1% at constant exchange rates).

- Underlying subscription revenues increased by 6% (and by 5% at constant exchange rates). Subscription growth continues to be generated by the group’s premium electronic information services such as BCA Research, the independent macro economic research house, and CEIC Data, the emerging markets data provider. Headline subscription revenues, including NDR, increased by 21%. Advertising revenues followed a similar trend to the second quarter – advertising from global financial institutions remained weak but this was offset by growth from the energy sector and emerging markets.

- The third quarter is the most important of the year for the event businesses, with many of the group’s largest events held during this period. While the bigger events put in a robust performance, markets became more challenging as the quarter progressed, particularly for smaller events. As a result, sponsorship revenues for the quarter fell by 7% while delegate revenues remained steady.

- The group generates nearly two thirds of its revenues in US dollars and movements in the sterling-dollar rate can have a significant impact on reported revenues. However, the average sterling-dollar rate for the third quarter was $1.60, against $1.64 a year ago, and the impact of exchange rates on revenues in the third quarter was not significant.

The following table summarises the year-on-year revenue changes for the third quarter at both headline rates and at constant exchange rates:

Financial Position

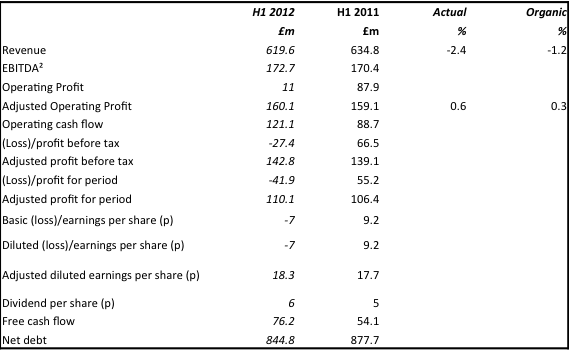

Net debt at June 30 was £51.3 million, a reduction of £37.2 million since March 31, reflecting the group’s strong operating cash flows in the period. The third quarter is traditionally the strongest of the year because of the importance of the cash flows of the event businesses. In addition there were no significant non-operating cash flows in the period and movements in the US dollar exchange rate had no significant effect on net debt levels.

UK, London

Related articles

- Euromoney Institutional Investor – trading update – half year profits of not less than £47M Posted on April 17, 2012

- A Fusion Deal: International grain trading conferences, Global Grain Geneva and Global Grain Asia, sold to Euromoney Institutional Investor Posted on February 29, 2012

- Euromoney Institutional Investor to acquire Ned Davis Research Group for £69M Posted on June 21, 2011

- Euromoney Institutional Investor PLC acquires Arete Consulting Posted on August 13, 2010

- Euromoney sells EIC to Broadfern September 2007

You must be logged in to post a comment.