DMGT has announced results for the third quarter of their financial year to 1st July 2012 .

Highlights

- Revenue for the third quarter of £509 million, up 3% on last year on a reported basis and up 4% on an underlying basis

- Continued good underlying growth from our B2B businesses

- Return to underlying growth at Associated Newspapers

- Net debt reduced by £9 million to £800 million

- Outlook for the year remains unchanged

Business to Business (B2B) – third quarter performance

RMS reported revenues were £42 million, with continued growth driven by core modelling performance as well as new product areas. The difference between underlying and reported revenue growth rates reflects the sale of RMSI in the fourth quarter of the prior year.

The reported revenues of dmg information grew strongly to £63 million, driven by Education (Hobsons) and Property (Landmark and EDR) businesses.

dmg events’ reported revenues increased to £29 million, reflecting a strong performance from the biennnial Global Petroleum Show in June.

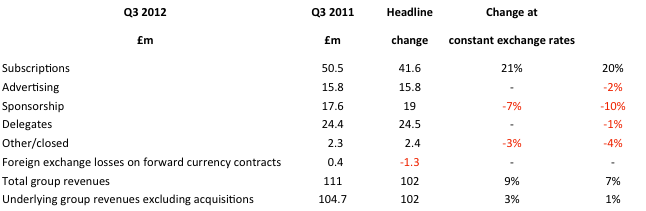

Continued good performance from Euromoney Institutional Investor, with reported revenues of £111 million.

Consumer – third quarter performance

Associated: reported revenues were £210 million, with circulation revenues up 4% and continued market share improvement (Daily Mail 21.6% compared to 21.0% last year and The Mail on Sunday 20.1% compared to 19.8% last year)*. Total underlying advertising revenues were up 2%; comprising newspapers down 5%, newspaper websites (mainly Mail Online) up 69% (when combined these two revenue streams were broadly in line with last year), and other digital advertising (primarily Evenbase) up 15%. For the first three weeks of July, total underlying advertising revenues were 3% ahead of last year.

Headcount reduced by a further 105 (3%) during the quarter to 3,809, 533 (12%) lower than at the start of the financial year.

Northcliffe: reported revenues were £54 million, with circulation revenues up 2% on an underlying basis, reflecting the benefit of recent cover price increases. Total underlying advertising revenues were down 7% in a difficult market. There is a continued focus on efficiency with costs reduced by 14%. For the first three weeks of July, total underlying advertising revenues were 7% below last year.

Headcount reduced by a further 86 (4%) during the quarter to 2,280, 251 (10%) lower than at the start of the financial year.

Net debt / financing

Net debt at 1st July, 2012 was £800 million, down from £809 million at 1st April, 2012. The Group continues to generate strong cash flows and these were primarily used to fund further acquisitions in the quarter. Acquisitions have now used £82 million of cash year to date (notably Jobrapido, Intelliworks, Xcelligent, Global Grain and Euromoney shares) with proceeds from disposals totalling £16 million year to date (notably the final instalment from the GLM disposal). Further debt reduction is expected in the fourth quarter.

UK, London

Related articles:

- Acquisition of Xceligentby DMGT Posted on April 27, 2012

- DMGT – trading update for the six-month period to the end of March 2012 Posted on April 17, 2012

- OFT clears the merger between the Digital Property Group and Zoopla Posted onApril 16, 2012

- DMGTacquires Jobrapido Posted on April 16, 2012

- FindaProperty, Primelocation and Zoopla to merge to take on Rightmove Posted onNovember 7, 2011

- DMGT sells GLM to Providence Equity Partners Posted on October 4, 2011

- DMGT trading update September 2011 Posted on September 28, 2011

- DMGT to sell GLM, the United States’ largest privately-held tradeshow management company Posted on June 10, 2011

- DMGT in “informal” talks to buy Express Newspapers Posted on April 4, 2011

- Could DMGT sell Northcliffe? Posted on November 28, 2010

- DMGT back on the acquisition trail? Posted on November 25, 2010

- Associated Northcliffe Digital acquires 50% of Globrix Posted on January 24, 2010

- Associated Northcliffe Digital buys Dothomes.co.uk and Extate.co.uk Posted on February 1, 2010

- Associated Northcliffe Digital acquires 50% of Globrix Posted on January 24, 2010

- Euromoney Institutional Investor to acquire Ned Davis Research Group for £69M Posted on June 21, 2011

- Euromoney Institutional Investor PLC acquires Arete Consulting Posted on August 13, 2010

- Euromoney sells EIC to Broadfern September 2007

You must be logged in to post a comment.